Profits per partner is a good metric for ranking law firms. Think about it. If you needed a quick method to assess the financial health of 100 law firms, using PPP partially removes size from your analysis and will bring you closer to identifying firms that are doing well, and those that are not.

But what if you aren’t in the business of ranking law firms? Law firm management needs to be keenly aware of the shortcomings of PPP, and how an overemphasis on this metric can lead to poor economic decisions.

Profits per partner: A double-edged sword

Ranking law firms makes for good press. It gives partners a goal, provides competitors insight as to where they stand amongst their peers, and puts a keen focus on profitability, not revenues.

The problem is: while PPP is great for ranking law firms, it’s an incomplete framework for making business decisions.

Why? PPP is backward-looking. It ignores the future and motivates law firm management to make bad economic decisions.

Law firm management: The distortion of PPP

When law firms place too much focus on maximizing current-period profits, something tends to “break”. Associates quit, either as a result of being overworked or an ineffective compensation strategy. Collection issues arise as the firm engages more clients. AFA’s fuel additional growth, until someone realizes they are depressing realization metrics.

Even worse, in a misguided effort to maximize profit per partner, some firms:

- Maximize utilization from their associates every week, deemphasizing training, business development, and endeavor that don’t involve billing clients

- Don’t hire until a lawyer quits or they have a “full plate” to serve incoming associates

- Don’t hire support staff until critical functions aren’t getting done

- Fail to pursue endeavors that set the foundation for higher profits in the future

An overemphasis on this year’s PPP sacrifices profitability in the future. It happens a lot. We try to borrow from the future in order to make today more profitable. Instead, economics dictate that we can’t “borrow” from the future. We can only steal. An over-emphasis on boosting PPP today steals from the health and stability of the law firm in the future.

Profits Per Partner: A case study

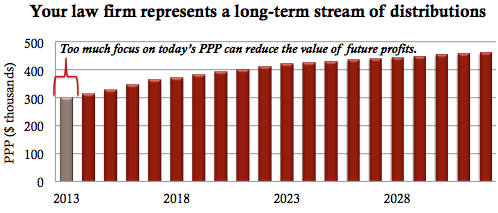

A well-run law firm is an economic engine that provides a long-term stream of compensation to the firm’s partners. This year’s PPP is just the first payment of a long-term series of distributions. If you focus too much on maximizing your income today, you will earn less in the future. Here’s an example:

Our example law firm has a steady stream of new opportunities that will enable the firm to increase revenues by 5% annually. Let’s assume for a moment that the firm chooses to maximize profits per partner. There will be no hiring or incremental investment in tools or technologies that will enhance productivity or profitability.

Everyone will work harder, and everyone will make more money, right? Maybe not.

If a 5% increase in revenues come at the cost of 10% associate turnover, partners lose. Why? Because if one associate quits, the cost of hiring her replacement and lost productivity cost each partner over $80k in compensation over the next five years.

$80k not enough? Our above example assumes that only one associate quits in the entire history of the firm. Continue to place too much focus on near-term productivity every few years, and each partner is throwing away compensation that quickly adds up to seven-figures.

Law firms are like cars. If you run them too hot, something eventually breaks. It may not seem like a big deal at the time (the loss of that reasonably productive associate, the departure of the ever-competent paralegal, a new client turns out to be a deadbeat), but each and every business issue either increases or decreases a partner’s future stream of distributions.

Profits per Partner: The long-term quotient

PPP is still a useful metric, and an incredibly important one at that. Used in the proper context, PPP holds many of the keys to financial success. But like most profitability metrics, profits per partner is only a measure of single-year profitability. As a result, it has its limits.

To maximize your compensation as a partner, you need to look at PPP as a stream of cash flows to which you are entitled over the course of your career. Balancing your focus on near-term profitability and long-term PPP can allow you to maximize your compensation, increase your wealth, and create a more valuable law firm.

Boost profit & growth with Business Performance Planning

Click to learn more!

Law Firm Consulting

Click here to learn more about law firm consulting & read a collection of our recent case studies

Own it.

Whenever someone says they want to “manage” something, I cringe.

I immediately ask myself, is there a better word? After all, words matter. The words we chose carry deep significance, not just because of their inherent meaning, but because they give insight into our actions. They cast light on our motivations.

So when people tell me they’re going to manage something (or even worse, manage-through something), I immediately try and discern whether they’re setting themselves up for failure.

After all, ownership breeds success. Management reeks of passivity.

read more

Why you can’t lose those 10 pounds – And why Oprah should run for President

Americans are obsessed with weight loss.

Our culture is fixated on it. Everywhere you turn you see diet books, commercials for weight loss products. There are entire television series devoted to it. It seems like everyone at Trader Joe’s is infatuated with kale.

Even Weight Watchers can’t seem to go wrong. Call it the Oprah effect.

read moreLaw Firm Consulting

Click here to learn more about law firm consulting & read a collection of our recent case studies