Business Strategy Insights

“Bridgesphere’s analysis and insights were critical in my Firm’s ability to grow and improve our finances.”

– Bridgesphere Client

Own it.

Whenever someone says they want to “manage” something, I cringe.

I immediately ask myself, is there a better word? After all, words matter. The words we chose carry deep significance, not just because of their inherent meaning, but because they give insight into our actions. They cast light on our motivations.

So when people tell me they’re going to manage something (or even worse, manage-through something), I immediately try and discern whether they’re setting themselves up for failure.

After all, ownership breeds success. Management reeks of passivity.

read moreWhy you can’t lose those 10 pounds – And why Oprah should run for President

Americans are obsessed with weight loss.

Our culture is fixated on it. Everywhere you turn you see diet books, commercials for weight loss products. There are entire television series devoted to it. It seems like everyone at Trader Joe’s is infatuated with kale.

Even Weight Watchers can’t seem to go wrong. Call it the Oprah effect.

read moreWhat’s your legacy?

Because in the end, that’s all that really matters . . .

read moreThe Hottest Thing on Tidal Since Beyoncé

Walking along Ocean Beach, I couldn’t help but gaze at the jaw dropping distance between where surf hit the sand and the waterline marking high tide from the night before.

A mere nine hours earlier, waves were crashing at a distance that would take a full 90 seconds to walk. To think that the gravitational pull of the moon and the sun are entirely responsible for these changes is astounding.

read moreMisery Loves Company: A Heatwave, Dr. Faustus & Economic Coincidence

Everybody’s talking about it. It’s hot. And it’s only April. Mission Dolores Park was overrun with Millennials (and those who wish they were Millennials) escaping the suffocating heat of their rent-control apartments.

The beaches were packed. The screen on your iPhone was hot enough to cause second-degree burns. We just had two of (hopefully) ten nights this year when San Franciscans wish they had air conditioning. Almost no one does.

read moreA Bridge To Nowhere – The art of getting unstuck

The other day, I was sitting in traffic trying to cross the Golden Gate Bridge. I needed to get to the North Bay to meet an important networking colleague and referral partner. It was a meeting that easily could have been a “catch up session” over the phone. But seeing as it was springtime, we aimed to meet at a favorite spot that has a fantastic reputation for sunny sidewalk seating, great Italian food, and rich espresso.

read moreThe Innovator & The Hoarder: Google vs. Yahoo & Lessons for your Business

Lot’s of news around Yahoo recently.

They’re up for sale. They’re not up for sale. Sell part of it. Sell all of it. An analyst hikes a target price. Another one downgrades. “Time wants to buy it!” “Verizon should buy it!”

Good Grief.

The headlines surrounding Yahoo are as ferocious as ever. Some to the positive, some to the negative. The name has always been controversial.

read moreCoffee With Daisy: Business, a Puppy and a Nike Mentality

What did you do this morning?

It’s a simple question. The answer, however, is loaded with all kinds of information about what you do for a living, whether you maintain work/life balance, and how seriously you take your health.

Over the years, I’ve had various morning routines that have empowered me to elevate my productivity during the “work day”. For those that are self-employed or run a business, the concept of a “work day” contains a lot of grey area. The phone rings, we answer.

read moreIs your business on a sugar high? Important lessons imparted by a gigantic doughnut.

I went to the food trucks with a friend on Friday night.

In San Francisco, you can just say that. Everybody knows what you mean. You go to an event hosted by Off The Grid, eat too much, and eventually succumb to the complimentary air conditioning provided by the Pacific Ocean.

An evening that starts in the mid 60’s can quickly dip to a wind-aided 53. When you’re digesting, that’s cold.

read moreHave Yourself a “Money Monday”

What are the three things you can do – today – that will improve revenue or boost profit? You got that right. It’s a one-day proposition. That’s what Money Monday is all about.

Three things. Map them out. Then . . . get started.

Here are a few ideas to inspire your Money Monday:

read moreStarry Night & The Painting of Economic Turbulence

Last week, I painted an economic picture of an overheated consumer and lousy corporate profits. I described an economic undertow that was working against the all too easy-to-paint picture of a bright and robust business environment.

This week, things got a little uglier.

read moreStay Thirsty: What The Most Interesting Man Had Right About Business

A ten year run in advertising. It doesn’t get much better than that. The Most Interesting Man in the World, who successfully peddled Dos Equis for an entire decade, is opting for a well deserved retirement and taking a one-way trip to Mars.

Don’t worry, you have until Cinco de Mayo to send him off and bid him a fond adieu. #AdiosAmigo.

read more2 Things Happened This Week That Should Terrify Small Business Owners

Every time I go to the beach, I am absolutely astonished. For one, there are more stars in the sky than there are grains of sand on all the beaches of the world. The very moment my feet hit the sand, that thought races into my mind. I quickly realize that I could hardly count the grains of sand in a single handful. Wow. Those are big numbers.

read moreLive Like We’re Dying – What Kris Allen, Jon Snow & Chipotle Teach Us About Management

I was running the other day. It was an easy route. 3 Miles. I’ve been hurt for awhile so in all honesty I’m thankful for the opportunity just to be out there on the streets at all.

After two-and-a-quarter pain free miles, I hit a downhill stretch of my route that descends out of Pacific Heights back towards the center of San Francisco. The prolonged descent used to be a part of the course where I just “put it in cruise control”, let it go, and enjoy the last stretch of the run.

read moreMoney For Nothing. I Want My MTV. What The Dire Straits Teach Us About Bubbles & Unicorns

As Sting opines in his cameo at the opening of Money For Nothing, we are back in a period of history where consumers (and businesses) want to consume everything. This time, we’ve taught them that they don’t have to pay for it.

read moreA Treatise on the Power of Nothing

On a deceivingly cold day on the Kennedy Expressway, I had the pleasure of inadvertently sharing a ride to the airport with an entrepreneur that had just sold her business. Despite the fact that the collapse of the technology bubble was in full-swing, this founder had just sold her company to a multinational conglomerate for a ripe eight-figure sum.

read moreContagion: 3 Shocks That Will Crush Small Business Performance in 2016

Why 0% interest rates, the price of oil, China, and $5 pour-over drip coffee are going to wreak havoc on your business . . .

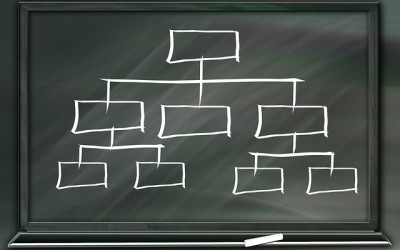

read more3 Keys To Successful Business Process Improvement

Why is focusing on business process so important? Regardless of whether your firm is impacted by external factors (the economy) or internal factors (events that impact your key people and functions), business process improvement offers you the opportunity to boost the performance of your organization.

read moreBusiness Process Improvement: A Case Study

Bridgesphere not only outlined a road map for improving our client’s business processes; our financial analytics identified $250k in profit improvement along the way.

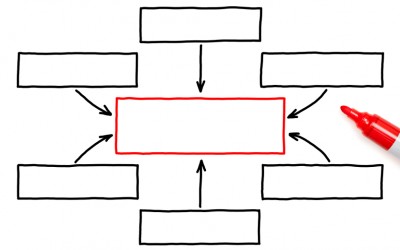

read moreMission Driven Management: Knowing the key drivers of profit & growth

Time flies over us, but leaves its shadow behind. — Nathaniel Hawthorne

Time is an incredibly valuable asset. Where management spends its time signals to employees what is important to a firm. Management time and focus also dictate what areas of the business will flourish and what business processes, products or services will languish.

read moreGoal Setting & Strategic Planning for 2016

In our recent meetings, we have been talking with companies about goal setting and strategic planning for 2016. Some organizations are struggling. Their financial performance is healthy, the economy is still looking strong, but goal setting and planning have taken a back seat.

read moreStrategic Planning: A Case Study

A Bay Area law firm with revenues of approximately $1Million, had successfully built a boutique practice over the course of several years. Recently, the Firm hit a roadblock. Management knew that an investment in people and processes would somehow unlock additional growth, but it was unclear what to do — or how to do it.

read moreSmall-Ball: A Winning Business Strategy

Ride & develop your winners, and consider strategic alternatives for the under-performing. Whether you are running a business or a Major League Baseball team, this principle is critical to long-term success.

read moreCreating Stakeholder Value in M&A

We believe that M&A can drive value. However, successful deals must have BOTH a positive strategic impact & favorable financial impact. Don’t fall victim to Ocean Effect; keep your head above water when considering the strategic & financial ramifications of potential transactions.

read moreStrategic Alternatives for Cash

According to recent data out of the Federal Reserve, corporate America is carrying record levels of cash. As of March, non-financial companies held 7% of their assets in cash and other liquid investments, up 26% from 2009 and the highest level recorded in nearly fifty years. On the face, this makes sense. The financial crisis of 2008 clearly caused many companies to elect to retain higher than normal cash balances in an attempt to preserve much-needed financial flexibility. It is likely that many companies are holding cash not only due to the many uncertainties that plague the current economic environment (a weak consumer, a likely increase in corporate taxes, and a possible double-dip recession), but also to fuel the next wave of mergers and acquisitions.

read moreThe Financial Demise of Blockbuster

Blockbuster, yet another retailer to meet its fate in Chapter 11, is an important example of what can happen to companies that employ the strategy of “disrupt, then defend”. At Bridgesphere, we believe that it is all-to-easy to play “Monday Morning Quarterback”. We do, however, believe it is useful to view Blockbuster’s tribulations through our framework, identify the key strategic / financial issue that essentially predetermined its demise, and most importantly consider: who could be next.

read moreGoogle vs. Yahoo: Continuous Disruptive Innovation

Within the internet world, both Google and Yahoo were certainly disruptive, forever changing the manner in which consumers (as well as businesses) interact with the internet. While both companies developed disruptive technologies & services, only Google has achieved what we would consider Continuous Disruptive Innovation. Its ability to dominate search, and then leverage its platform into a portfolio of disruptive technologies & services has created tremendous value for shareholders, not to mention a long-term stream of impressive earnings and cash flows.

read moreWhat is Continuous Disruptive Innovation?

Disruption: In the world of business strategy and finance, this word is particularly meaningful. In a simplistic sense, disruption is defined as an innovation that improves a product or service in ways that the marketplace does not expect. Disruption can often be game-changing, forever altering the competitive balance within a market or industry. At Bridgesphere, we classify the concept of disruption into two primary strategies:

read moreApple: Continuous Disruptive Innovation

In October of 2001, Steve Jobs & Company unveiled the iPod. At $400 and the inability to interface with Windows, the product largely appealed to a select group of “power users”, music fanatics who also happened to be Apple loyalists.

For many companies, the development of the iPod would have been the culmination of years of R&D investment and would have transitioned into some sort of an endgame. Sure, the product would likely advance through additional development and innovation, but the primary strategy would center around growing the business and defending the resulting earnings and cash flows against traditional competitors, the majority of which would be the purveyors of competing digital music devices.

read moreCreating Stakeholder Value in Social Media

Creating networks of like-minded (and also not-so-like-minded) participants has facilitated the emergence of new companies and entirely new industries. Social networks such as Facebook, professional sites such as LinkedIn, and gaming companies (Zynga, Ngmoco, etc.) have experienced hyper-growth in users, revenues, and enterprise value in just a matter of years.

read moreBusiness Performance Planning

Take your business to the next level. Boost profit & growth with a game plan used by multinational corporations

Research & Insights

Our latest thinking on business strategy, financial strategy, as well as a collection of our latest case studies

About Bridgesphere

Learn more about Bridgesphere, its founder, and how we help clients solve their most complex problems