Creating Stakeholder Value in M&A

We believe that well-executed acquisitions can be tremendously value creative. However, successful transactions are typically the exception, not the rule.

Why M&A can be a good idea

If a firm cannot organically grow its business into high ROI ventures, they should consider buying a company who can. While the old adage makes sense, “if you can’t build it, buy it”, we believe this strategy is overly simplistic in the world of corporate strategy and M&A. Acquisitions, to us, have two primary attributes:

- Strategic Impact

- Financial Impact

Get either of these wrong, and even the most brilliantly conceived corporate marriage is ripe for disaster and unlikely to deliver value to stakeholders.

Bridgesphere’s M&A Framework

We think of M&A as just one strategic option available to corporate managers, and a risky one at that. Primary benefits include significant short-term growth and an enhanced competitive position within an industry. Primary pitfalls include overpaying for the target and difficulties achieving desired synergies & strategic goals.

We think of M&A as just one strategic option available to corporate managers, and a risky one at that. Primary benefits include significant short-term growth and an enhanced competitive position within an industry. Primary pitfalls include overpaying for the target and difficulties achieving desired synergies & strategic goals.

In order to execute a deal in which the benefits outweigh the pitfalls, we apply our Strategic M&A Matrix. Our framework divides an acquisition into two segments:

- Strategic Impact

- Financial Impact

Strategic Impact

Every transaction needs to have a positive strategic impact on the acquiring firm. At Bridgesphere, we analyze potential deals through our Value Creation Framework focusing on two primary attributes: a deal’s lifecycle implications, and whether a transaction is likely to enhance a firm’s competitive position within a given industry.

The Lifecycle Analysis

When considering the lifecycle implications of a deal, we start by considering two primary questions:

1. What is the economic track record of the target (as measured by ROIC) and where does the target lie on the corporate lifecycle?

2. How does the combined firm’s position on the corporate lifecycle compare to the acquirer’s pre-acquisition?

While not all transactions will have a meaningfully beneficial impact on a firm’s lifecycle attributes, we believe that many truly game changing deals improve a company’s competitive position along the corporate lifecycle. Consequently, the lifecycle implications of a proposed transaction should always be considered in conjunction with a deal’s strategic and competitive ramifications.

Strategic & Competitive Analysis

The second step in considering the strategic impact of any proposed deal is to analyze the strategic and competitive implications of the transaction. Here, we seek to answer:

1. What is the target’s competitive position within its industry

2. How does the combined firm’s competitive position compare to the acquiring firm on a stand-alone basis?

Both of these questions can be thoroughly addressed in a robust and systematic fashion via Bridgesphere’s Value Creation Framework. Our proprietary return on invested capital metric, the analysis of relevant value drivers, and our lifecycle framework empower management teams and investors to determine whether a proposed transaction will have a positive strategic impact on the acquiring firm.

Financial Impact

After it is concluded that a deal has a positive strategic impact, it is equally important to assess whether a proposed deal will have a positive financial impact on the combined entity. Even the most brilliantly conceived transactions are ripe for disaster if they don’t have a positive financial impact on the newly-combined firm.

We divide a transaction’s financial impact into two distinct components:

- Value Derived from Deal Execution

- Value Achieved through Synergies & New Opportunities.

Deal Execution: A transaction can have a positive financial impact for the acquirer (and its stakeholders) if a target is acquired at a price less than the value of its discounted future cash flows. Much like an institutional investor can drive value through the purchase of a stock whose current price implies an overly pessimistic scenario for a firm’s future earnings & cash flows (such as any Apple investor circa 2005), a corporate manager can create value by purchasing targets whose value isn’t fully reflected in the public or private marketplace (think: good serial acquirers such as Warren Buffett’s Berkshire Hathaway).

Synergies & New Opportunities: While deal execution doesn’t necessary have to be a source of value in a transaction, we believe that a proposed transaction must, in its entirety, have a positive financial impact on the combined firm for a deal to create value for stakeholders. Whether this value is derived from deal execution or the achievement of synergies & new opportunities is irrelevant. Even if a deal is executed at a significant premium to a target’s stand-alone discounted cash flows, a deal can still have a positive financial impact if the value derived from synergies & new opportunities (as measured by discounting the future cash flows of the combined entity) outweigh the premium.

However, it must be stressed that in order to be value creating for stakeholders, a proposed deal (in some sort of combination between value derived from deal execution and synergies) must have a positive financial impact on the combined firm. Any value-creating deal must make sense: strategically & financially.

The Ocean Effect: Why M&A is typically unsuccessful

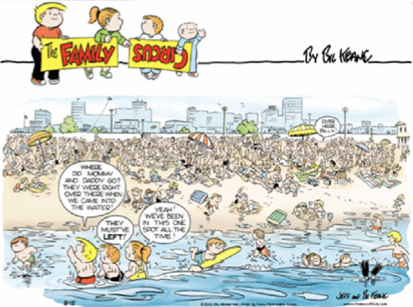

An M&A transaction is like a vast ocean — an ocean full of potential purchase prices, strategic opportunities, political issues, cultural concerns, and ego. Management teams often become overwhelmed (whether they know it, or not). We think this concept is playfully depicted in a recent Family Circus cartoon:

Much as children lose their perspective of the beach while playing in the ocean, management teams often lose touch with the economic realities of a proposed transaction when a deal’s strategic benefits are enticing, and a surface-level analysis of the synergies & new opportunities is compelling.

Whether manifested though large deal premiums or multiple competing bidders, Ocean Effect can have disastrous ramifications for stakeholders. At its core, Ocean Effect is more than a simple lack of financial discipline. Ocean Effect starts with a loss of perspective. Sometimes “great M&A ideas” should remain, “just ideas” when they cannot be achieved in a financially prudent fashion.

We look back on many of the major transactions in Pharma and Telco during the 1990’s and early 2000’s. Many of those deals failed to create value (as measured by relative stock market performance). These transactions rarely materialized into shareholder wealth.

A recent Bloomberg study drives this home. Of the 100 largest transactions between 2005 and 2008, 53 cases resulted in relative underperformance versus industry benchmarks in the two years subsequent to the deal.

We believe that M&A can drive value. However, successful deals must have BOTH a positive strategic impact & favorable financial impact. Don’t fall victim to Ocean Effect; keep your head above water when considering the strategic & financial ramifications of potential transactions.

Boost profit & growth with Business Performance Planning

Click to learn more!

Management Consulting

Click here for more about management consulting & read a collection of our recent case studies

Own it.

Whenever someone says they want to “manage” something, I cringe.

I immediately ask myself, is there a better word? After all, words matter. The words we chose carry deep significance, not just because of their inherent meaning, but because they give insight into our actions. They cast light on our motivations.

So when people tell me they’re going to manage something (or even worse, manage-through something), I immediately try and discern whether they’re setting themselves up for failure.

After all, ownership breeds success. Management reeks of passivity.

read more

Why you can’t lose those 10 pounds – And why Oprah should run for President

Americans are obsessed with weight loss.

Our culture is fixated on it. Everywhere you turn you see diet books, commercials for weight loss products. There are entire television series devoted to it. It seems like everyone at Trader Joe’s is infatuated with kale.

Even Weight Watchers can’t seem to go wrong. Call it the Oprah effect.

read more

What’s your legacy?

Because in the end, that’s all that really matters . . .

read more

The Hottest Thing on Tidal Since Beyoncé

Walking along Ocean Beach, I couldn’t help but gaze at the jaw dropping distance between where surf hit the sand and the waterline marking high tide from the night before.

A mere nine hours earlier, waves were crashing at a distance that would take a full 90 seconds to walk. To think that the gravitational pull of the moon and the sun are entirely responsible for these changes is astounding.

read moreManagement Consulting

Click here for more about management consulting & read a collection of our recent case studies

Boost profit & growth with Business Performance Planning

Click to learn more!

Business Performance Planning

Take your business to the next level. Boost profit & growth with a game plan used by multinational corporations

Research & Insights

Our latest thinking on business strategy, financial strategy, as well as a collection of our latest case studies

About Bridgesphere

Learn more about Bridgesphere, its founder, and how we help clients solve their most complex problems