Law firm management teams often have to make very difficult decisions. Last week, Weil Gotshal announced a round of layoffs that gained a significant attention in the financial press.

What can we learn from the layoffs at Weil Gotshal?

Layoffs not only impact those who lose their jobs, but they also have long-term implications on the culture and financial health of the firm. Law firm management teams can learn a lot from the decisions made by their competitors. When considering the moves at Weil Gotshal, we seek to provide insights into the following questions:

- Were these layoffs a sound business decision?

- What are the implications for the industry?

- How does this impact my firm?

Were these layoffs a sound business decision?

At the end of the day, time and financial performance will reveal whether or not Weil made the ideal business decision. However, our analysis of Weil’s decision and the prevailing industry conditions, suggests that the Firm acted in the best interest of its long-term profits per partner. Of particular importance, the Firm indicated that:

- Industry supply-demand balance is “out of whack”

- The firm was taking action “from a position of strength”

Source: New York Times

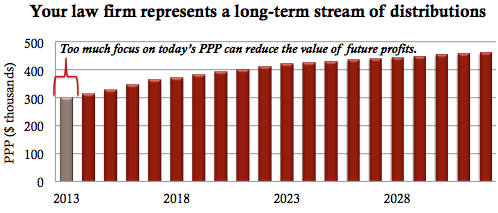

As we have discussed in previous articles, the value of a law firm is derived from the long-term stream of distributions to which partners are entitled. It’s one thing to make hasty decisions today in an attempt to maximize profits per partner in 2013. However, prudent business decisions involve maximizing the value of partner compensation over the long-term.

Layoffs are rarely cheap. 2013 profits per partner is unlikely to be the primary beneficiary of Weil’s decision. A reduction in headcount rarely has a positive impact on law firm culture or productivity. Moreover, if Weil provided six months severance to those impacted (as reported in the New York Times), then 2013 profits per partner has little to do with this decision. The majority of the firm’s cost savings and any material upswing in productivity is unlikely to be achieved until 2014 and beyond.

The Weil Gotshal layoffs hardly appear to be a short-sited decision. In fact, it may have been their best option. Weil made the right move if mitigating overcapacity today yields a higher level of profits per partner in future years.

While we will have to wait for time and financial performance to yield a definitive verdict, we believe that this decision was about profits per partner in the future, rather than a move intended to boost short-term performance.

Industry implications for law firm management

A significant component of Weil’s decision appears to be macro-driven. Management referenced declining demand for high-end legal services as the “new normal”. Some have speculated that there is 10% overcapacity in Biglaw. If that is the case, then layoffs such as these should hardly come as a surprise.

Overcapacity doesn’t discriminate. Law firm management teams face the same economic pressures that faced the steel, automotive, and airline industries at various points in history. The difference is that unlike their industrial counterparts, law firms are high-margin businesses. Consequently, law firm management teams have a better set of options to consider when faced with overcapacity.

We believe overcapacity in Biglaw will divide the industry into two camps:

- Law firm management teams that address overcapacity when they can

- Law firm management teams that address overcapacity when they have to

Those that effectively mitigate the symptoms of overcapacity sooner rather than later are likely to be the long-term winners.

Why? Any short-term disruption in culture, PR, and cash flows can be addressed well-before the end of fiscal 2014. Competitors that make difficult decisions later in the game will likely be doing so when their financial performance is worse, and their competitors’ profits per partner is already on the rise.

How does this impact my firm?

Regardless of a law firm’s size, profits per partner will continue to carry greater weight in defining long-term success. Why? Because growth is becoming harder to achieve.

Profits per partner will be an ever-increasing factor in determining which firms are able to achieve above industry-average growth. This is a trend that will impact the largest firms (who attempt to capture a larger share of a shrinking pie) and the smaller firms who endeavor to grow faster than their competitors.

Profits per partner & the “new normal”

Perhaps a few overly short-sited management teams will make cuts primarily in an effort to boost 2013 profits per partner and meet the overly-optimistic expectations of their partners. Short-cited decisions rarely create a platform for long-term growth.

Expect growth-oriented law firms to employ strategies (which may even include layoffs) that set the table for above industry-average growth in the future.

Law firm management teams that position themselves for a more profitable 2014 & 2015 will be better-positioned to achieve growth in an industry where growth is quickly fading away.

Profits per partner is your law firm’s currency:

In reality, profits per partner is more than a metric to measure a firm’s financial health. PPP is becoming a law firm’s currency.

In an industry where growth is fading, law firms with higher profits per partner will be better positioned for growth. Law firm management teams that endeavor to grow their firms faster than their competitors need to have healthy profits per partner in order to attract key talent. In fact, profits per partner will become a more critical driver of a law firm’s ability to grow as industry-level growth declines.

We think this will force more firms to address overcapacity when they can, rather than when they have to.

Address overcapacity in 2013, and law firm management teams can position themselves for improved profits per partner in 2014 and beyond. Healthy profits per partner will allow certain firms to obtain a larger share of a shrinking pie.

In fact, law firms that earn high (and increasing) profits per partner over the next 3-5 years may have an opportunity to attract key talent as their competitors face stagnant (or declining) economic performance.

In summary, it appears that the layoffs at Weil was a long-term decision. Firms that endeavor to grow faster than their competitors will need to produce quality profits per partner in order to attract key talent. Even layoffs (as painful as they are) can set the table for long-term growth and higher profits per partner.

Boost profit & growth with Business Performance Planning

Click to learn more!

Law Firm Consulting

Click here to learn more about law firm consulting & read a collection of our recent case studies

Own it.

Whenever someone says they want to “manage” something, I cringe.

I immediately ask myself, is there a better word? After all, words matter. The words we chose carry deep significance, not just because of their inherent meaning, but because they give insight into our actions. They cast light on our motivations.

So when people tell me they’re going to manage something (or even worse, manage-through something), I immediately try and discern whether they’re setting themselves up for failure.

After all, ownership breeds success. Management reeks of passivity.

read more

Why you can’t lose those 10 pounds – And why Oprah should run for President

Americans are obsessed with weight loss.

Our culture is fixated on it. Everywhere you turn you see diet books, commercials for weight loss products. There are entire television series devoted to it. It seems like everyone at Trader Joe’s is infatuated with kale.

Even Weight Watchers can’t seem to go wrong. Call it the Oprah effect.

read more

What’s your legacy?

Because in the end, that’s all that really matters . . .

read moreLaw Firm Consulting

Click here to learn more about law firm consulting & read a collection of our recent case studies