The Innovator & The Hoarder: Google vs. Yahoo & Lessons for your Business

Lots of news around Yahoo recently

They’re up for sale. They’re not up for sale. Sell part of it. Sell all of it. An analyst hikes a target price. Another one downgrades. “Time wants to buy it!” “Verizon should buy it!”

Good Grief.

The headlines surrounding Yahoo are as ferocious as ever. Some to the positive, some to the negative. The name has always been controversial.

But why the big fuss?

It’s easy. If you’ve ever watched a train wreck, you instantly understand that while the humanity inside of us doesn’t want to see the carnage, curiosity often wins the day.

When was the last time you slowed down . . . and looked . . . when there was an accident on the highway? There you go.

I am not being funny. Yahoo is a BIG company. It’s responsible for billions and billions of dollars in shareholder money. You probably own some in your IRA. Check those mutual fund statements. You’ll be surprised to learn what you own.

See, when you’re responsible for over $50 Billion in shareholder money, and you magically turn it into $30 Billion — people notice. And the feedback isn’t that great.

What makes matters worse is when member of your management team appears at a major investor event and makes a statement like this:

“I’ve never seen anything like the amount of attention we get given our size. You get papers in New York that — I’m not quite sure why they think we are so interesting as a company. It’s amazing to me”. — Ken Goldman, CFO of Yahoo as reported by Business Insider.

There better be one hell of backstory to that quote.

That is perhaps one of the most financially irresponsible comments I have read from a C-Level executive in the last decade. Sorry. It’s the truth.

When a company has spent the better part of fifteen years treading water while their main competitor is knocking it out of the park — it’s a train wreck — and people look.

When you’re the CFO of a company that’s seen a 30% decline in value during one of the final innings of a raging bull market, people care. They notice. They analyze. They try to figure out why you should be interesting.

Why?

Because you ARE interesting. Too bad you don’t seem to agree.

Here’s the backstory

It’s interesting. And there’s a lesson in here for all of us.

Yahoo is a company that has destroyed about $15 Billion in shareholder value in the past year. That’s 30%. Over the past decade, the company has struggled to hold on to any meaningful improvement in value.

When compared to it’s chief rival, Google? The results are plain as the midday sun over the silicon-lined stretch of Highway 101 that connects Sunnyvale to Mountain View.

Google’s been rolling while Yahoo’s been toiling . . .

How did this happen?

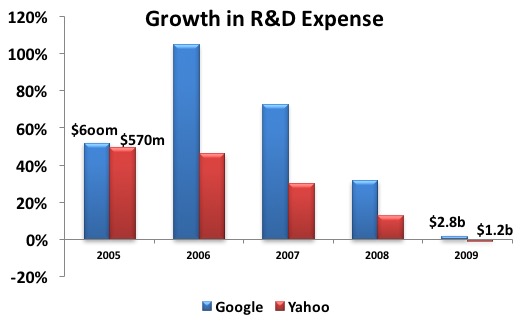

It’s simple, really. It all goes back to the mid-2000’s. 2005 to be precise. See, it was a time when Google was massively outspending Yahoo in research & development. It was a time when both companies were feverishly competing to be the best in “search”. It was a time when the two companies went down two diametrically opposed paths to achieve growth.

Google headed north, along the famed Hwy 101, building its business through enormous investments in research & development. Just look at how much more Google plowed into self driving cars, robots, email, AI, chat, glasses, logistics, analytics . . . the list goes on.

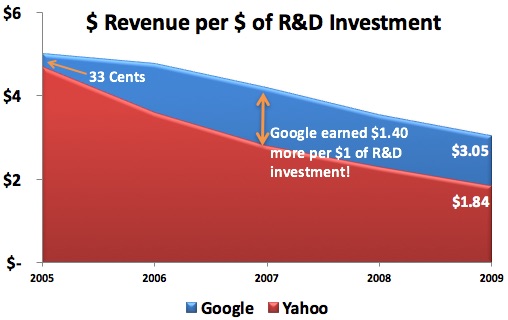

And they earned more money on their research!

Not only did Google out-invest their chief internet rival over the critical five year period that ended in the dearth of the financial crisis, but they earned more money on that investment.

You read that right. They invested more. Way more. And they earned more. Way more.

In fact, Google earned over $1 more in revenues for each dollar invested in R&D expense between 2005 & 2009.

Google innovated while Yahoo hoarded

While Google was busy plowing billions of enormously profitable dollars into their research & development budget, Yahoo acquired. And by acquired, I mean they bought (or tried to buy) almost everything for sale under the Silicon Valley sun.

After doing several blockbuster deals during the height of the internet bubble (buying Broadcast.com for almost $6 Billion and web hosting company GeoCities for $3.6 Billion), Yahoo went on a decidedly lower-ticket buying spree in the mid 2000’s, buying a bunch of websites and other technology plays to add to its growing list of “properties”.

The point is this. Their R&D budget was paltry compared to Google’s. And their M&A strategy failed to create shareholder value. Nothing happened. From either strategy . . .

To be fair, Google did a few acquisitions during that time

Actually, they bought a bunch of stuff too. But the thing is, they bought DoubleClick which massively upped their ad game. They also bought a video sharing concept you may have heard of (or even used). It’s called YouTube.

They both spent a lot of money

They really did. While both companies spent a sizable sum on acquisitions, the biggest differentiator was that Google bet on itself. It invested in its own research & development efforts at a level that far outpaced its competitor.

They invested more. Each dollar invested was way more profitable. The results are striking. Google has outperformed yahoo by over 1,000%

And when they did acquire other companies — their biggest acquisitions were home runs. Acquisitions that either enhanced their most profitable line of business (ads) or extended their most famous product offering (search).

You gotta stay true to yourself — or else you’re a disservice to others

I picked on Yahoo because they don’t get it. The quote from their CFO affirms it. The performance of their stock proves it. They waste other people’s money.

For any business owner, whether you run a $100 Million company or a $1 Million company, there are lessons in Yahoo for all of us.

Stay true to yourself

Do what you do. Do it well. Keep doing it. Someone will notice.

In the case of Google, they invested in R&D. They invested more than Yahoo. They did it better than Yahoo. They kept doing it. Investors noticed.

There’s a lesson in there for all of us.

- Do what you do

- Do it well

- Keep doing it

- Someone will notice

Happy Monday. Now go do . . . what you do!

Like what you're reading?

Join our newsletter to receive our latest research & insights!

You have Successfully Subscribed!

Boost profit & growth with Business Performance Planning

Click to learn more!

Management Consulting

Click here for more about management consulting & read a collection of our recent case studies

Law Firm Consulting

Click here to learn more about law firm consulting & read a collection of our recent case studies

Own it.

Whenever someone says they want to “manage” something, I cringe.

I immediately ask myself, is there a better word? After all, words matter. The words we chose carry deep significance, not just because of their inherent meaning, but because they give insight into our actions. They cast light on our motivations.

So when people tell me they’re going to manage something (or even worse, manage-through something), I immediately try and discern whether they’re setting themselves up for failure.

After all, ownership breeds success. Management reeks of passivity.

read more

Why you can’t lose those 10 pounds – And why Oprah should run for President

Americans are obsessed with weight loss.

Our culture is fixated on it. Everywhere you turn you see diet books, commercials for weight loss products. There are entire television series devoted to it. It seems like everyone at Trader Joe’s is infatuated with kale.

Even Weight Watchers can’t seem to go wrong. Call it the Oprah effect.

read more

What’s your legacy?

Because in the end, that’s all that really matters . . .

read more

The Hottest Thing on Tidal Since Beyoncé

Walking along Ocean Beach, I couldn’t help but gaze at the jaw dropping distance between where surf hit the sand and the waterline marking high tide from the night before.

A mere nine hours earlier, waves were crashing at a distance that would take a full 90 seconds to walk. To think that the gravitational pull of the moon and the sun are entirely responsible for these changes is astounding.

read more

Misery Loves Company: A Heatwave, Dr. Faustus & Economic Coincidence

Everybody’s talking about it. It’s hot. And it’s only April. Mission Dolores Park was overrun with Millennials (and those who wish they were Millennials) escaping the suffocating heat of their rent-control apartments.

The beaches were packed. The screen on your iPhone was hot enough to cause second-degree burns. We just had two of (hopefully) ten nights this year when San Franciscans wish they had air conditioning. Almost no one does.

read more

A Bridge To Nowhere – The art of getting unstuck

The other day, I was sitting in traffic trying to cross the Golden Gate Bridge. I needed to get to the North Bay to meet an important networking colleague and referral partner. It was a meeting that easily could have been a “catch up session” over the phone. But seeing as it was springtime, we aimed to meet at a favorite spot that has a fantastic reputation for sunny sidewalk seating, great Italian food, and rich espresso.

read more

Coffee With Daisy: Business, a Puppy and a Nike Mentality

What did you do this morning?

It’s a simple question. The answer, however, is loaded with all kinds of information about what you do for a living, whether you maintain work/life balance, and how seriously you take your health.

Over the years, I’ve had various morning routines that have empowered me to elevate my productivity during the “work day”. For those that are self-employed or run a business, the concept of a “work day” contains a lot of grey area. The phone rings, we answer.

read moreBusiness Performance Planning

Take your business to the next level. Boost profit & growth with a game plan used by multinational corporations

Research & Insights

Our latest thinking on business strategy, financial strategy, as well as a collection of our latest case studies

About Bridgesphere

Learn more about Bridgesphere, its founder, and how we help clients solve their most complex problems