The Sound of Silence: Why a fading economy is about to destroy your law firm as you know it

It’s hardly news

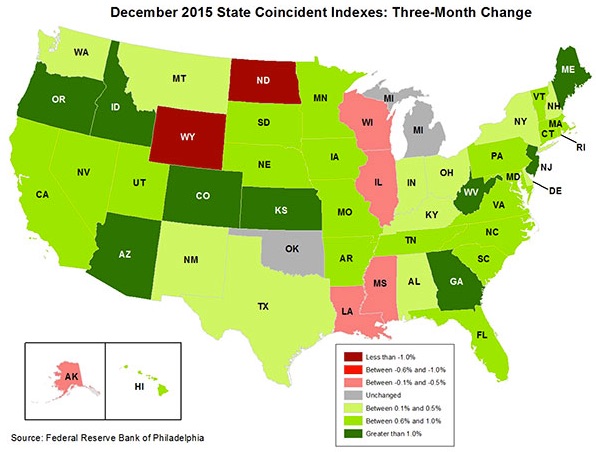

The economy is starting to fade. Recession-esque statistics are already impacting states from the Midwest to the Plains. Another undercurrent, often unnoticed in the sea of economic data, is legal revenues. They started to tail-off again in the fourth quarter.

Is your firm ready?

The business climate in America is changing. And not for the better. Your clients’ inventories are rising. Their sales have been stagnant (at best) for eighteen months. Consumer credit is dangerously high. Experts say it’s at a level dangerously close to where delinquencies rise and banks start to pull-back credit lines. Corporate earnings are plunging.

All this puts your law firm at risk

Sure, your firm survived the collapse of the tech bubble. You made it through the financial crisis. But what have you done to prepare for an economic slowdown that will only be compounded by the presence of many more “boutique” and “virtual” law firms than existed a mere eight years go?

The evolution of AFA’s, increased competition from “smaller firms”, the proliferation of practice management suites that enhance efficiency, pricing pressure from clients, and a lackluster trend in realized and collected rates have made the competitive environment for legal services drastically different than that which existed immediately before the previous two recessions.

Are you ready? Do you have a plan? What are you going to do about it?

The sound of silence

Every time I take on a new client, I ask them the same question. While the first meeting of any engagement is centered around learning about the law firm, management, prevailing trends, chief concerns, goals, mandates & how the firm’s history plays a role in today’s performance — I always get around to asking one question.

What was it like around here during December of 2008? Describe what it felt like. What did it look like? What did it sound like?

While the answers take many forms (business owners and C-Level executives are incredibly descriptive in their portrayal of the financial crisis), there is one answer I get far more than any other.

Silence.

The phones stopped ringing. Emails stopped flooding my inbox. People went silent. Clients shuttered their doors. I filed a lot of bankruptcies. I stopped doing deals. My firm could barely keep the lights on.

The pain was real

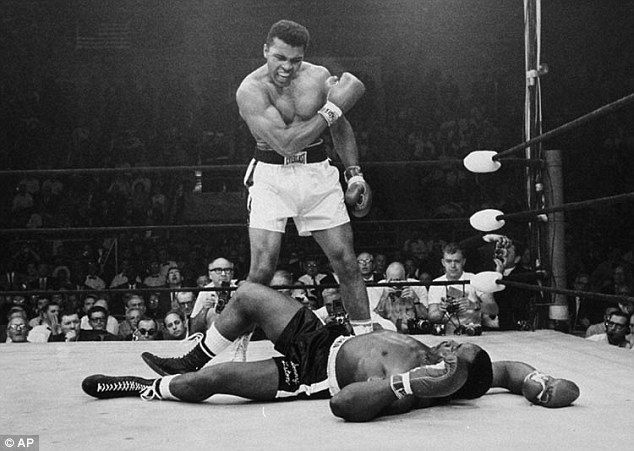

Things might seem okay now, but the economy is about to give law firms a brutal punch.

It’s like Sonny Liston in his second fight against Muhammad Ali in May of 1965. Everything seemed normal. Good, in fact. It was the first round. It was a fast pace. Sonny threw a seemingly inconsequential left jab, only to have The Greatest come over it with a fast right. That was it. It was over. It was an epic blow that descended into chaos.

With the proverbial writing on the wall and the early rounds of an economic slowdown at hand, here are a few things you can do to prepare.

Stress test your law firm. Find your vulnerabilities.

Perhaps one of the most notable long-term consequences of the financial crisis is the requirement for financial institutions to undergo stress tests. Here, banks and other systemically critical financial institutions are required to assess how they would survive under a variety of adverse financial scenarios.

This is how banks assess their vulnerabilities. You should do a similar exercise for your law firm.

Do thorough diagnostics of your people and clients. Who’s generating enough revenue? Who’s profitable? What needs to improve?

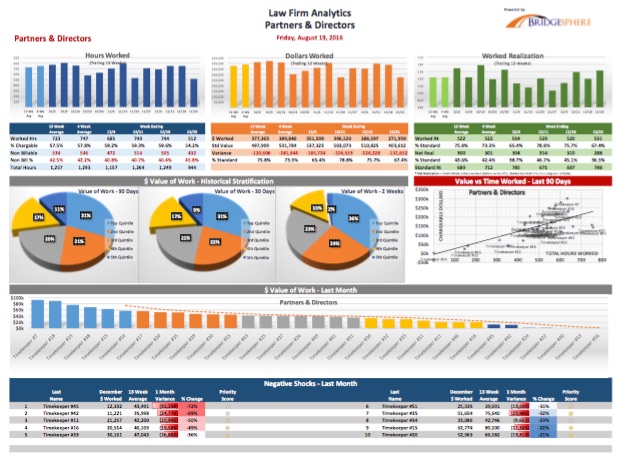

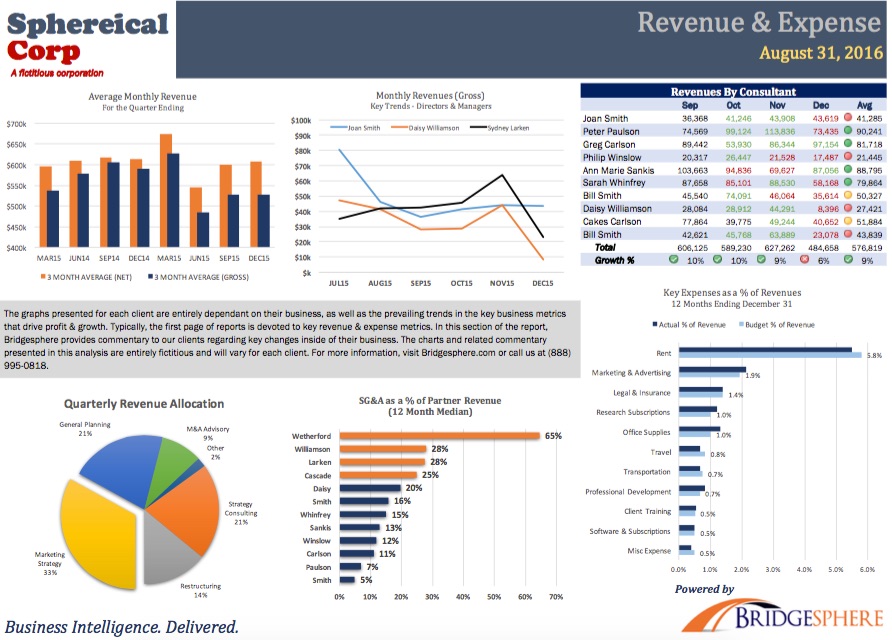

Conducting an analytical review of your law firm (or even just its critical practice groups) can reveal a lot of new information. Using analytics on a quarterly or semi-annual basis can help senior management gain a better understanding of what’s working inside of their law firm, and what attorneys, practice groups, and clients are posing financial headwinds.

To learn more about Law Firm Analytics, view a sample report & receive a complimentary white paper on strategic planning, click here.

Review your law firm’s KPI’s. Detect financial issues before they become full-blown problems.

When was the last time your law firm conducted a thorough review of your Key Performance Indicators (or, KPI’s). Do you know what financial trends are changing? Are you looking at your firm’s financial performance using the same dashboards and reports that you created a few years ago?

The reality of any business is that KPI’s change over time. While the fundamental drivers of profit and growth may be eternal, the prevailing financial trends that are exerting the most headwinds on your business are constantly changing.

Having an independent set of eyes using cutting edge algorithms to detect critically important financial deviations before they become full-blown problems just might be the financial edge you need to stay one step ahead of the competition.

Business Performance Planning helps law firms spend more of their time running their business, rather than analyzing it. Cutting edge algorithms and twenty years of strategic financial experience make a proverbial molehill out of a mountain of financial data.

To learn more about Business Performance Planning, view sample reports & receive a complimentary white paper on mission-based management, click here.

Where do you stand on BPI?

Everyone likes to talk BPI – but have you done it? What did it do for your bottom line? If it didn’t improve your profits, then something went wrong . . . or you didn’t do enough.

Business process improvement is critical for law firms, just as it is for any other type of business. The reality is this. The larger your firm, the higher the probability your law firm has processes that are far less efficient than your smaller competitors. This lack of efficiency puts you at a competitive disadvantage — one that is exacerbated when revenues decline and additional pressure is placed on rates.

What can you do about it?

Having a list of processes that you deem inefficient isn’t enough. Should all of them be improved? What processes are costing you the most money? Which BPI endeavors offer you the highest return on investment?

Conducting a review of your core business processes through a financial lens that is specifically designed to improve profits per partner will help you focus on the right areas for improvement.

Focus on what matters. Nothing else. Improve the systems that will protect profits per partner and enhance your law firm’s ability to survive the next economic downturn

At this point, everything else on the “wish list” is simply a waste of time.

Click here to learn more about our approach to BPI & read a quick case study on how we helped a client modernize their law firm.

Is practice management just a committee, or a reality?

So you have a practice management committee. That’s great. How much have they added to your bottom line? Have you done what it takes to allow practice management solutions to make your law firm more competitive in the marketplace? Or is it just a committee? A consultant. Something that a handful of lawyers complain about? A nuisance.

Let there be no doubt. Practice management initiatives can have a dramatic impact on your law firm. Aside from making your practice more efficient, these initiatives need to be implemented in a way that reduces your overhead.

With a downward pressure on rates and the reality of a softening economy, practice management initiatives absolutely have to cut overhead. Unless they provide a financial buffer that allows your law firm to preserve profits per partner under adverse financial conditions, your practice management committee isn’t doing its job. In fact, without the financial benefits, practice management efforts are not only a waste of time & money but provide a false sense of security that your law firm is “doing the right thing” and “staying competitive”.

It’s great to have all the bells and whistles, but if they aren’t making you more profitable, then they are as useless a single hose fighting a three-alarm fire. Simply put — practice management solutions are here for a reason. They are making thousands of law firms around the country more competitive — more profitable.

Make it more than a committee. Make it a profit center. Otherwise, your law firm is at risk.

The landscape is drastically different than eight years ago. Law firm size matters more than ever.

And, no. Bigger is not necessarily better.

If your firm has 100 lawyers or more, The boutique & virtual law firms are going to use their size and low overhead rates to crush you. There were fewer of them at the onset of the last recession. They are biting at your ankles now. They are biding time until they can steal your entire meal.

Unless they are properly positioned, mid-sized law firms are the proverbial belly of the beast. They are trying to have the “best of both worlds”. Some size, but not too much. Some of the “best of Biglaw” but with a “small firm feel”. It might be the most dangerous business model ever created. Ranging in size between 100-300 attorneys, they serve a mixture of corporate and mid-market clients.

This is the segment of law firms at greatest risk. This is the belly of the beast. Some will dissolve, disband. Some will try and “buy their way out” of their strategic dilemma through M&A. Some will find their fate tied to closing a successful sale (a.k.a. an exit strategy).

Others will just wither away as the best and brightest are no longer willing to carry the weight of an aging and economically ill-fit law firm on their back.

These law firms are literally creating their own worst enemy

Disenfranchised partners are either going to make a lateral move while eating their former employer’s lunch or just start their own firm – instantly creating another boutique with decades of experience, lower overhead rates, and a technological (I dare say, competitive) advantage over their larger brethren.

To make matters worse, these mid-sized law firms are often less diverse than their Biglaw counterparts. They are less diversified across practice areas. They’re almost always constrained to a tighter geographical footprint. These two factors will only exacerbate the financial pain brought on by a softening economy and increasingly competitive market for legal services.

Being stuck in the middle is a bad place to be

It always has been. Since the dawn of capitalism.

Mid-sized law firms in parts of the country that are particularly sensitive to the nuances of economic cycles are at immediate risk. When client mix gravitates toward an economically deteriorating clientele and the law firm’s geography is concentrated in locales where economic growth becomes increasingly unsustainable, things will get really messy. Quick.

Mid-sized firms that have taken BPI, AFA’s, and practice management endeavors seriously will thrive. They will grow. Prosper. Those that have ignored the proverbial writing on the wall will wither. It has happened in every industry in the history of capitalism. The bell is ringing for the legal industry. In fact, it’s been ringing for a long time.

Godzilla will get the headlines

Similar to previous economic downturns, a handful of large firms will go belly-up. It’s hardly a surprise. The writing is on the wall. And while The Wall Street Journal and local business rags will tell the cautionary tale of a firm overly leveraged on contingency fees, the price of oil, real estate, M&A, IPO’s, VC deals or work for startups that are simply running out of cash, the real story will play out at a multitude of smaller firms that don’t grab the headlines.

The pain will be played-out in the belly of the beast. The middle of the market. The law firms that are making the same strategic mistakes that have doomed countless public and private companies in more competitively-developed industries.

The mid-sized firms that die are the one’s trying to be “Wal-Mart” when they’re really more like “Sears”. New committees, fancy software, a commitment to change won’t do a thing to boost their bottom line. Economics is bread through action. Change is forged in effort, heartache, some conflict, and a heavy dose of willpower.

How bad does your firm want it?

Smaller Law Firms Won’t Get a Free Pass

It’s true. Smaller law firms will be best-able to weather the impending economic storm, so long as they have business processes in place to keep the top-line fed, and systems that enable them to service clients in a better, faster, cheaper, and more efficient manner than larger industry constituents.

It’s true. Smaller law firms will be best-able to weather the impending economic storm, so long as they have business processes in place to keep the top-line fed, and systems that enable them to service clients in a better, faster, cheaper, and more efficient manner than larger industry constituents.

But an economic and competitive advantage is not a free pass. It’s not a “get out of jail free” card. It’s earned. A critical weakness of smaller law firms is a lack of focus on planning, process & people. Those that have done it well will thrive. Those that have used the “boutique” or “virtual” nature of their law firm to serve as a substitute for planning, process & people will languish.

In fact, If you’re a boutique or “virtual” firm, here is some great guidance on how to get the process started.

Have you addressed structural issues that are keeping you less competitive?

When times get tough, self-preservation will prevail. It always does. The difference in this economic cycle is that those that choose to “abandon ship” will not only have more options — they’ll have more compelling options.

Are you doing what it takes to keep the breadwinners happy? Are they carrying too much economic dead-weight?

Did you address the tough issues? If you wait until the downturn is in full-swing, it will be too late and the consequences will be devastating.

If you haven’t, there are allocations of time and labor (not just between departments, but between partners and associates within given departments) that will be entirely unsustainable when a slowdown hits. The economic merry-go-round is still spinning awfully fast. Firms that deleveraged coming out of the financial crisis are making it work. But is the current allocation of labor enough to get the job done when the proverbial stink hits the fan?

Are you your client’s creditor?

If your receivables are in bad shape now, they’re about to get a whole lot worse. Do you have a system in place that holds partners accountable for the receivables of their clients?

Accountability, not accounting, is the key to receivables management. We are asked by firms all the time if we can provide a better lens through which they can view, monitor and analyze their receivables. We do that in our business performance planning. It helps. A lot.

But no matter how we do it — no matter how we stratify, age and analyze receivables, it all comes down to accountability. Does your firm have a process in place to put the right people “on the case” of aging receivables?

Does a partner get involved before a receivable becomes delinquent?

If aging and delinquent receivables aren’t impacting a partner’s compensation, I can almost guarantee you that at some point — you are going to have a problem. You’re going to get burned.

I hope all of your attorneys aren’t compensated on “chargeable” hours. The incentive to charge isn’t nearly the same is the reality of collection. That’s true in all phases of the economic cycle. But in an economy that is rolling over? Watch out. Shorten your cash cycle not only through persistent analysis of your receivables — but through accountability.

Analysis gives rise to insight. Accountability gives rise to action.

The benefits will compound as the economy rolls over.

Is your firm doing lots of work well below standard rates?

I’m going to cut to the chase on this one. I’m not talking about contingency matters that don’t work out as planned. I am not talking about the occasional bath almost every firm takes on a poorly constructed AFA. I am not talking about that 20% discount you had to provide to land the business. I’m talking about doing work for major corporations at really low rates (think: around $100 per hour). It happens. It never ceases to amaze me.

When the merry-go-round of capitalism is whirling around at a feverish pace fueled by unsustainably low interest rates, doing (practically free) work for large multinational corporations, unicorns, and those your firm believes are the “up-and-coming-unicorns” can work. And by work — I mean cover some overhead. It certainly detracts from profits per partner. It often prevents the attorneys working on such matters from obtaining the experience and professional development they need to maximize their benefit to the future success of your firm.

But it works today because as the economic tide rises, these business decisions can be justified as “investments” or “client retention” mechanisms.

The problem is this. When the recession hits and your phones stop ringing, this type of work acts like a sledgehammer to your bottom line. The negative economic leverage is as deadly as a freshly sharpened guillotine.

What percentage of your WIP was done at rates at or near your breakeven rate? Do you know the answer? How does that answer change when 15% – 25% disappears from your top line?

That’s the question you are going to have to answer. How bad is this type of work going to hurt your financial performance when things slow down? Will you even be able to sustain that type of work? What about those jobs?

The sad reality is that associates in those roles are often robbed of the professional development that will make them long-term assets to the firm. Even worse, it actively incentives such attorneys to defect, and start their own “boutique” with your name on their resume.

Biglaw & mid-sized law firms are the greatest startup incubators of the last decade

They have arguably created as many thriving, profitable, and job-creating businesses as Silicon Valley. And that’s not a knock on law firms, nor is it a condemnation of the birthplace of Apple, Alphabet et al.

Rather, it’s the reality facing law firms across the country. The industry is giving birth to the very businesses that will bring many of the biggest to their knees.

It won’t just be the biggest that survive. In fact, some of the biggest will face the same fate as the countless mid-sized law firms that signed their death certificate as soon as they decided to commit “the best of Biglaw”, but with “a small firm feel”. In the world of economics, that’s a commitment to financial confusion. Lots of the same overhead without a lot of the pricing power.

Only the strong will survive. Businesses bolstered by planning, people, process and systems. Firms that don’t just have committees devoted to Business Process Improvement, Big Data, Practice Management — firms that have used them to boost their bottom line.

If you have already seen profitable results from any of these endeavors, congratulations. You’re eons ahead of the competition.

Take action.

Before the sound — is silence.

Like what you're reading?

Join our newsletter to receive our latest research & insights!

You have Successfully Subscribed!

Boost profit & growth with Business Performance Planning

Click to learn more!

Law Firm Consulting

Click here to learn more about law firm consulting & read a collection of our recent case studies

Own it.

Whenever someone says they want to “manage” something, I cringe.

I immediately ask myself, is there a better word? After all, words matter. The words we chose carry deep significance, not just because of their inherent meaning, but because they give insight into our actions. They cast light on our motivations.

So when people tell me they’re going to manage something (or even worse, manage-through something), I immediately try and discern whether they’re setting themselves up for failure.

After all, ownership breeds success. Management reeks of passivity.

read more

Why you can’t lose those 10 pounds – And why Oprah should run for President

Americans are obsessed with weight loss.

Our culture is fixated on it. Everywhere you turn you see diet books, commercials for weight loss products. There are entire television series devoted to it. It seems like everyone at Trader Joe’s is infatuated with kale.

Even Weight Watchers can’t seem to go wrong. Call it the Oprah effect.

read more

What’s your legacy?

Because in the end, that’s all that really matters . . .

read more

The Hottest Thing on Tidal Since Beyoncé

Walking along Ocean Beach, I couldn’t help but gaze at the jaw dropping distance between where surf hit the sand and the waterline marking high tide from the night before.

A mere nine hours earlier, waves were crashing at a distance that would take a full 90 seconds to walk. To think that the gravitational pull of the moon and the sun are entirely responsible for these changes is astounding.

read more

Misery Loves Company: A Heatwave, Dr. Faustus & Economic Coincidence

Everybody’s talking about it. It’s hot. And it’s only April. Mission Dolores Park was overrun with Millennials (and those who wish they were Millennials) escaping the suffocating heat of their rent-control apartments.

The beaches were packed. The screen on your iPhone was hot enough to cause second-degree burns. We just had two of (hopefully) ten nights this year when San Franciscans wish they had air conditioning. Almost no one does.

read more

A Bridge To Nowhere – The art of getting unstuck

The other day, I was sitting in traffic trying to cross the Golden Gate Bridge. I needed to get to the North Bay to meet an important networking colleague and referral partner. It was a meeting that easily could have been a “catch up session” over the phone. But seeing as it was springtime, we aimed to meet at a favorite spot that has a fantastic reputation for sunny sidewalk seating, great Italian food, and rich espresso.

read more

Mirror, Mirror on the Wall: On law firms, BPI and a moment of reflection

Where were you eight years ago? It would have been April, 2008.

The market was off a bit over 10%. Nothing to worry about. Just a correction.

Legal revenues were robust. Growing at a healthy 5% clip.

Then the world changed. In an instant.

Where were you? Sometimes it helps to look in the mirror . . .

read more

The Innovator & The Hoarder: Google vs. Yahoo & Lessons for your Business

Lot’s of news around Yahoo recently.

They’re up for sale. They’re not up for sale. Sell part of it. Sell all of it. An analyst hikes a target price. Another one downgrades. “Time wants to buy it!” “Verizon should buy it!”

Good Grief.

The headlines surrounding Yahoo are as ferocious as ever. Some to the positive, some to the negative. The name has always been controversial.

read more

Coffee With Daisy: Business, a Puppy and a Nike Mentality

What did you do this morning?

It’s a simple question. The answer, however, is loaded with all kinds of information about what you do for a living, whether you maintain work/life balance, and how seriously you take your health.

Over the years, I’ve had various morning routines that have empowered me to elevate my productivity during the “work day”. For those that are self-employed or run a business, the concept of a “work day” contains a lot of grey area. The phone rings, we answer.

read more

Is your business on a sugar high? Important lessons imparted by a gigantic doughnut.

I went to the food trucks with a friend on Friday night.

In San Francisco, you can just say that. Everybody knows what you mean. You go to an event hosted by Off The Grid, eat too much, and eventually succumb to the complimentary air conditioning provided by the Pacific Ocean.

An evening that starts in the mid 60’s can quickly dip to a wind-aided 53. When you’re digesting, that’s cold.

read more

Have Yourself a “Money Monday”

What are the three things you can do – today – that will improve revenue or boost profit? You got that right. It’s a one-day proposition. That’s what Money Monday is all about.

Three things. Map them out. Then . . . get started.

Here are a few ideas to inspire your Money Monday:

read more

Starry Night & The Painting of Economic Turbulence

Last week, I painted an economic picture of an overheated consumer and lousy corporate profits. I described an economic undertow that was working against the all too easy-to-paint picture of a bright and robust business environment.

This week, things got a little uglier.

read more

Stay Thirsty: What The Most Interesting Man Had Right About Business

A ten year run in advertising. It doesn’t get much better than that. The Most Interesting Man in the World, who successfully peddled Dos Equis for an entire decade, is opting for a well deserved retirement and taking a one-way trip to Mars.

Don’t worry, you have until Cinco de Mayo to send him off and bid him a fond adieu. #AdiosAmigo.

read moreBusiness Performance Planning

Take your business to the next level. Boost profit & growth with a game plan used by multinational corporations

Research & Insights

Our latest thinking on business strategy, financial strategy, as well as a collection of our latest case studies

About Bridgesphere

Learn more about Bridgesphere, its founder, and how we help clients solve their most complex problems